are taxes cheaper in arizona than california

For instance the lowest-income 20 percent of Arizonans contribute 13 percent of their. Cost of living California is 293 more expensive than Arizona.

Alameda County Ca Property Tax Calculator Smartasset

Since 2008 average monthly wireless service bills per subscriber have dropped by 26 percent from 50 per line to about 37 per line.

. California has one of the highest state unemployment tax rate with minimum UI tax rate from 15 vs. Arizonas tax system has vastly different impacts on taxpayers at different income levels. If you factor in all of the tax breaks allowed to a homeowner who actually lives in the property then surprising things happen.

On average Californians will part with up to 93 in income tax. Compare these to California where residents owe. Property tax per capita.

You should expect to pay less for auto insurance once you move. There are a couple of ways to do this. Are taxes cheaper in Arizona than California.

Im wondering why people tell me its cheaper for me to live in Sun City than California. This tool compares the tax brackets for single individuals in each state. Arizona Taxes vs.

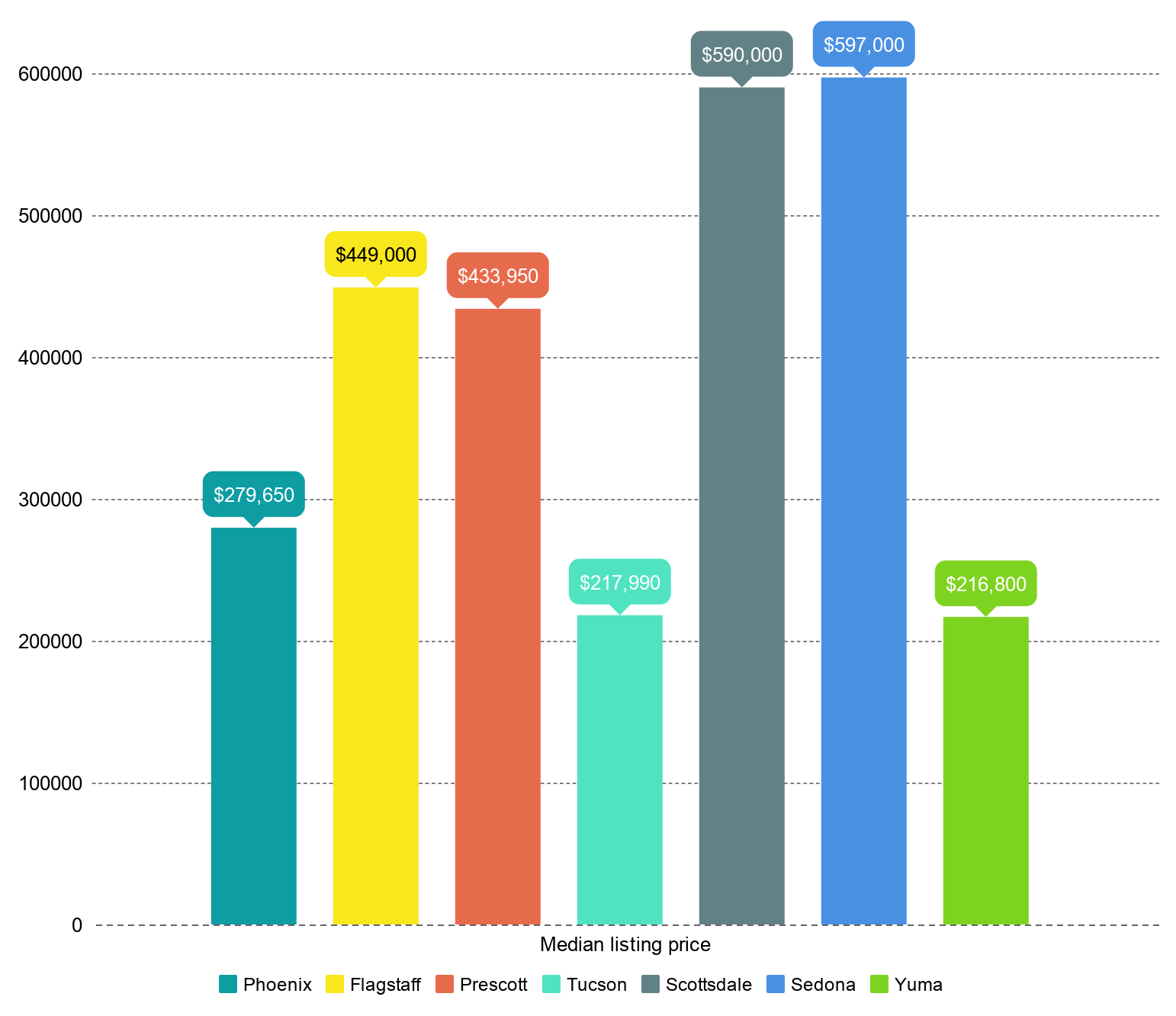

Overall state tax rates range from 0 to more than 13 as of 2021. In fact you can live in some amazingly nice areas of California for almost nothing. - Overall Los Angeles California is 621 more expensive than Phoenix Arizona.

- Median Home Cost is the biggest factor in the cost of living difference. No state has a single-rate tax structure in which one. You can hardly ignore the vast difference in property taxes between these two states.

Arizona car insurance average premiums. State sale tax is also lower in Arizona being 660 in comparison with 725 in California. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in.

Income Tax Rates. Answer 1 of 14. But while Arizonas reputation as a low tax state is accurate for wealthy households it bears little resemblance to reality for the states less affluent residents.

But in California the. Thirty-two states levy graduated income tax rates similar to federal tax brackets although brackets differ widely by state. These states are as follows.

If to compare the average cost of living in Phoenix Arizona and. 1 Subsidized Housing I once met a woman a single mom who was able to buy an amazing brand new house. 454 State sales tax.

Florida follows with a new vehicle registration fee of 225. I just checked and according to the tax Foundation Arizona has the second highest. None The tax burden in Arizona is small compared with that of other states because of its lower-than.

Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. The tax burden in Arizona is small compared to that of other states because of its lower-than-average. Registration fees following the first fee.

In 2022 single taxpayers with incomes of up to 27272 in Arizona will see a 255 income tax rate while those earning more than that will have to pay 298. For example on the heat map below California is. 2297 139 percent of the average sales price.

In California single tax filers earning up to 9326 will pay 1 those earning between. This is a one-time fee and there are separate additional fees based on the vehicles weight. A median house in Ohio valued at 129900 brings in 2032 in property taxes.

California can be very cheap to live in. The typical annual car insurance rate in Arizona is. Payroll taxes are a significant factor to consider too.

2284 138 percent of the average sales price. However wireless taxes have increased by. Wyoming homes tend to be a tad higher than some of the other states here but with no state income tax and a 4 state sales tax Wyoming is one of the most affordable.

66 Property tax per capita. Use this tool to compare the state income taxes in Oregon and California or any other pair of states. Is it cheaper to live in Arizona than California.

Arizona is 177 cheaper than. In Ohio the tax property rate is the 12th highest in the country at 156.

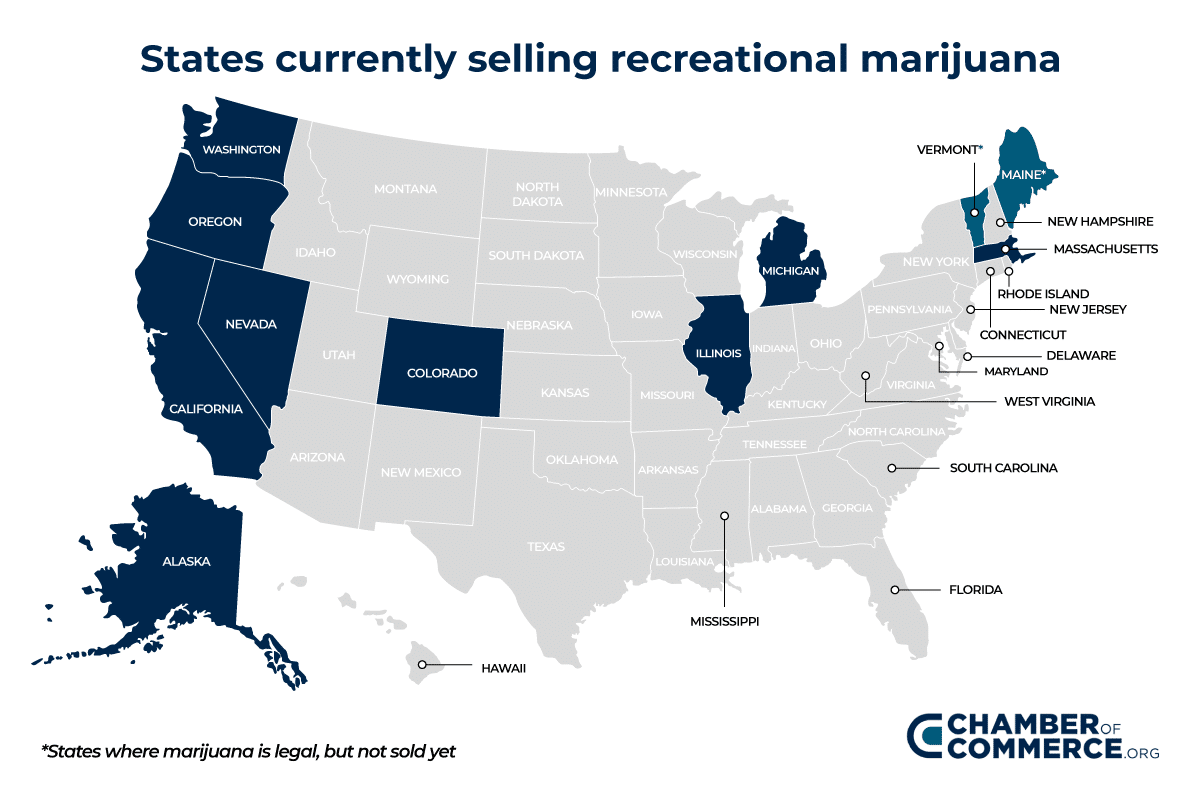

Taxing Marijuana Which Recreational States Levy The Highest Taxes Chamber Of Commerce

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

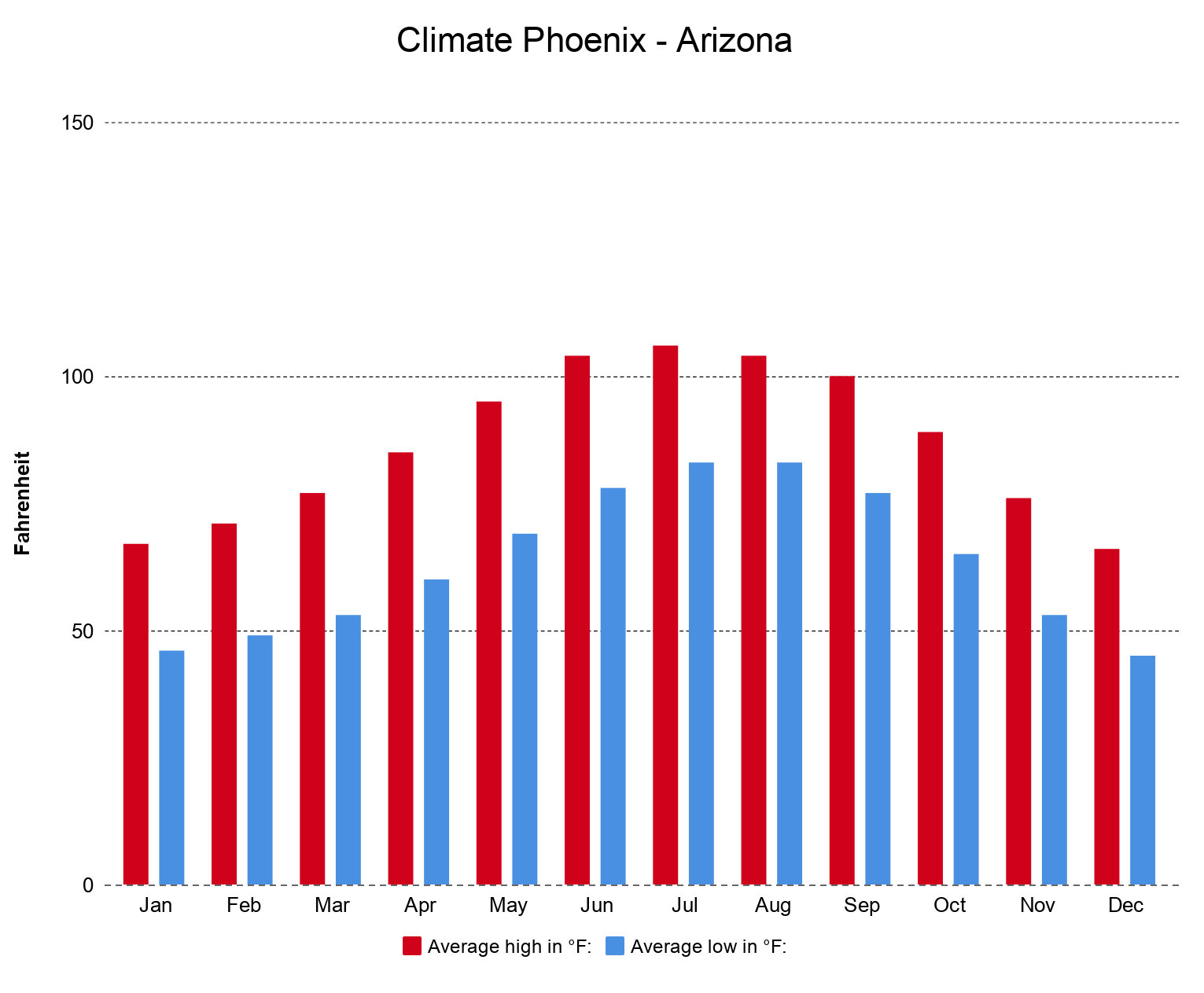

Pros And Cons Of Moving From California To Arizona Californiamoversusa

/US_states_by_GDP_per_capita_nominal-f89d1ca278a649a9b47e858ee41e7f09.png)

Cost Of Living In Texas Vs California What S The Difference

Pros And Cons Of Moving From California To Arizona Californiamoversusa

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Move From California To Las Vegas Moving To Las Vegas Las Vegas Visit Las Vegas

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Nevada Vs California Taxes Explained Retirebetternow Com

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Land For Sale In California Land For Sale Mohave County Rural Land

How Do State And Local Sales Taxes Work Tax Policy Center

Property Tax Comparison By State For Cross State Businesses

State Income Tax Rates Highest Lowest 2021 Changes

Moving From California To Arizona Benefits Cost How To

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact